Is claiming the cost of gluten-free grocery items on my taxes worth the time & effort?

Canada Revenue Agency: Medical Expenses – Gluten Free Products 1

Canada Revenue Agency: Medical Expenses – Gluten Free Products 1

“Persons with celiac disease (gluten intolerance) can claim the incremental costs associated with buying gluten-free products as a medical expense. The incremental cost is the difference in the cost of gluten-free products compared to the cost of similar products with gluten. It is calculated by subtracting the cost of a product with gluten from the cost of a gluten-free product.

Generally, the food products are limited to those produced and marketed specifically for gluten-free diets, such as gluten-free bread. Other products can also be eligible if they are used by the person with celiac disease to make gluten-free products for their own use. These include, but is not limited to, rice flour and gluten-free spices.

If several people eat the product, only the costs related to the part of the product that is eaten by the person with celiac disease may be claimed as a medical expense.

Do not send any supporting documents. Keep them in case we ask to see them later. You will need to keep all of the following:

- a letter from a medical practitioner that certifies that the person has celiac disease and needs a gluten-free diet

- receipts for each gluten-free food product that is claimed

- a summary of each food product that was bought during the 12-month period for which the expenses are being claimed (see example below)”

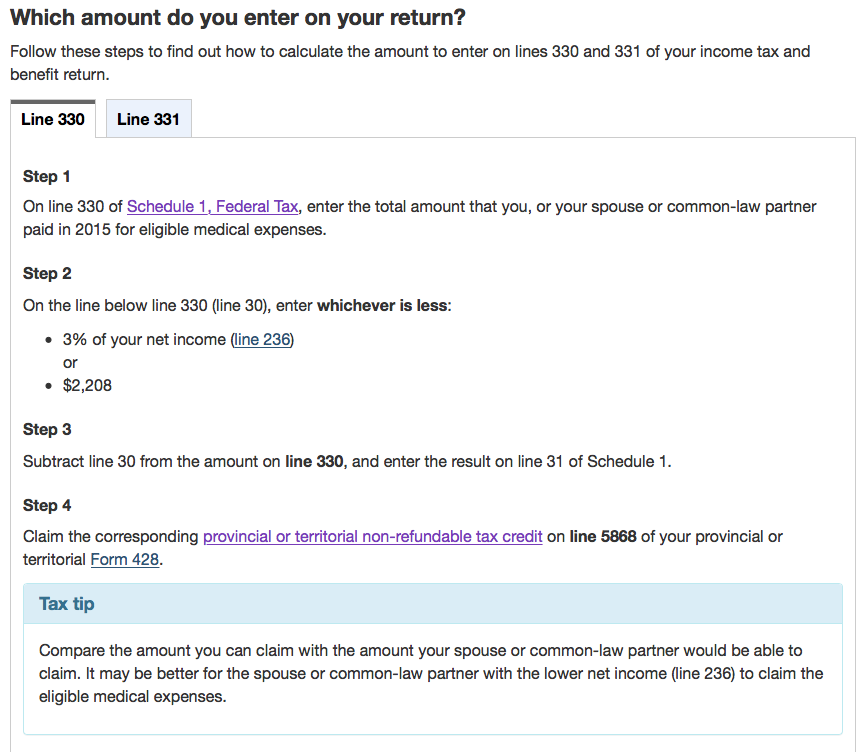

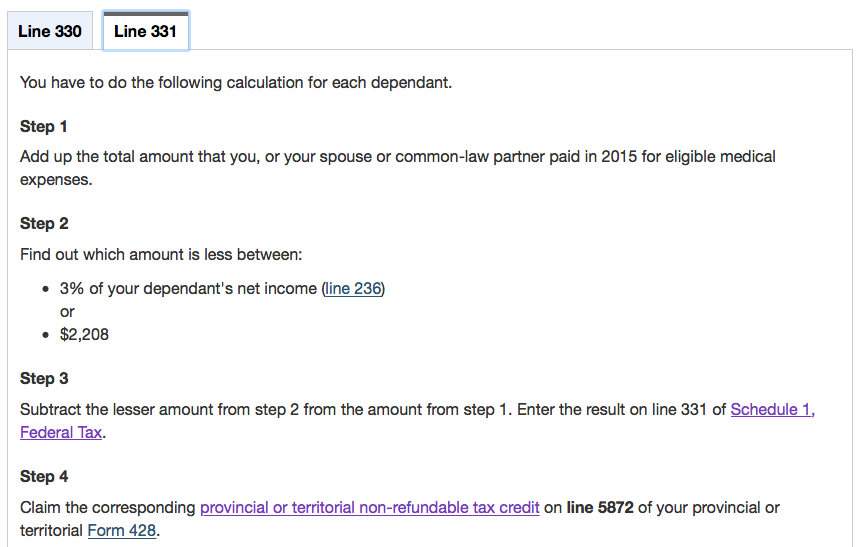

NOTE: “Your claim must be greater than either 3% of your net income or a fixed amount that the CRA sets from year to year, whichever is less. For more information on the medical expense claim and the current year’s fixed amount.” 2 See ‘Line 330 and 331’ below.

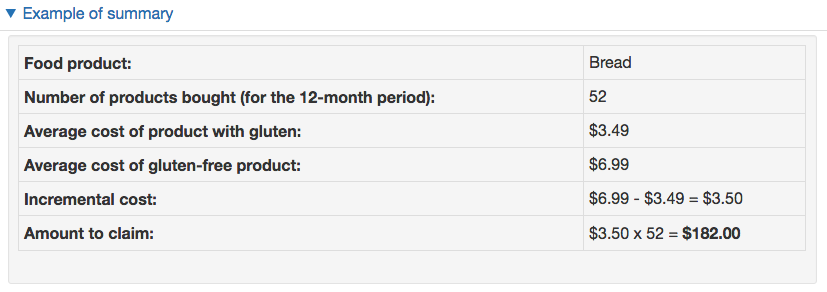

What is the “incremental cost”?

What is the “incremental cost”?

The incremental cost is the difference in the cost of GF products compared to the cost of similar non-GF products. It is calculated by subtracting the cost of a non-GF product from the cost of a GF product (see example below).

What items are eligible?

What items are eligible?

Generally, the food items are limited to those produced and marketed specifically for GF diets. Such items include, but are not limited to, GF bread, bagels, muffins, and cereals.

Intermediate items will also be allowed where the patient suffering from celiac disease uses the items to make GF products for their exclusive use. These include, but are not limited to, rice flour and GF spices.

What if there are several people consuming the GF products?

What if there are several people consuming the GF products?

If several people consume the products, only the costs related to the part of the product consumed by the person with celiac disease are to be used in calculating the medical expense tax credit.

What documents do I need to support a claim for the medical expense tax credit?

What documents do I need to support a claim for the medical expense tax credit?

If you are filing your income tax and benefit return electronically or on paper, do not send any supporting documents. However, keep the following documents in case we ask to see them at a later date:

- a letter from a medical practitioner confirming the person suffers from celiac disease and requires GF products as a result of that disease

- a receipt to support the cost of each GF product or intermediate product claimed

- a summary of each item purchased during the 12-month period for which the expenses are being claimed (see example below)

Cost regular vs GF bread (per slice)

Example

1. Item: bread

2. Number of items purchased: 52

3. Average cost of non-GF product: $3.49

4. Average cost of GF product: $6.99

5. Incremental cost (line 4 minus line 3): $6.99 – $3.49 = $3.50

6. Amount to claim (line 5 multiplied by line 2): $3.50 x 52 = $182.00

from www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns300-350/330-331/dtlxpns-eng.html#gltnfr

Which amount do you enter on your return? 4

Provincial or territorial non-refundable tax credit5

What happens if medical treatment [i.e. diagnostic testing] is not available in my hometown? 3

What happens if medical treatment [i.e. diagnostic testing] is not available in my hometown? 3

- If certain conditions are met, the CRA will allow you to claim reasonable travel expenses to get medical treatment.

- Distance is the first factor. If you have to travel at least 40 kilometres one way from your home to the medical services establishment, you may be able to claim the cost of public transportation.

- If public transportation is not readily available, you may be able to claim the vehicle expenses you paid.

If you had to travel at least 80 kilometres one way from your home to the medical services establishment, you may be able to claim these expenses, in addition to your transportation costs provided:

- The same medical services cannot be available near your home.

- You have to take a reasonably direct route to get to the medical services.

- It should be reasonable under the circumstances for you to have travelled to that place for those services.

How much you can claim depends on which method you use to calculate your travel expenses. With the detailed method, you keep track of all of your vehicle expenses for the year and make the claim based on the number of kilometres you drove for medical reasons versus the number you drove for other reasons. With the simplified method, you claim a per-kilometre rate for travel for medical reasons.

Footnotes

- https://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns300-350/330-331/dtlxpns-eng.html#gltnfr (scroll down to ‘gluten-free’)

- https://www.cra-arc.gc.ca/vdgllry/ndvdls/srs-txmsrs-pwd3-eng.html

- https://www.cra-arc.gc.ca/vdgllry/ndvdls/srs-txmsrs-pwd3-eng.html

- https://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns300-350/330-331/menu-eng.html#whchlns

- Provincial or territorial non-refundable tax credit

Helpful Video Series: https://www.cra-arc.gc.ca/vdgllry/ndvdls/srs-txmsrs-pwd-eng.html?clp=ndvdls/srs-txmsrs-pwd3-eng&fmt=mp

Individual income tax and trust enquiries: Phone: 1-800-959-8281 (Canada and United States)